If you are looking to enhance your trading experience, Pocket Option is one platform that offers a variety of tools and resources for traders of all levels. Whether you are a novice or an experienced trader, understanding the intricacies of online trading can significantly impact your success. This article will delve into various trading strategies, market analysis techniques, and tips that can help you navigate the trading landscape effectively on the Pocket Option platform.

Introduction to Pocket Option

Pocket Option is an innovative trading platform that allows users to trade a wide array of financial instruments, including forex, cryptocurrencies, stocks, and commodities. With its user-friendly interface, Pocket Option has gained popularity among traders looking for a reliable and efficient trading partner. The platform is equipped with several features that enhance the trading experience, including social trading, a demo account, and various analytical tools.

The Importance of Trading Strategies

Developing a coherent trading strategy is crucial for long-term success in trading. A well-defined strategy helps traders make informed decisions, manage risks effectively, and maximize their profits. On Pocket Option, you can employ various strategies depending on your trading style and risk tolerance. Let’s explore some of the most effective trading strategies that can be utilized on Pocket Option.

1. Trend Following Strategy

The trend following strategy is one of the most popular approaches in trading. The principle behind this strategy is simple: you trade in the direction of the market trend. By identifying upward or downward trends, traders can capitalize on price movements. On Pocket Option, traders can utilize various indicators, such as moving averages or the Relative Strength Index (RSI), to spot trends and make informed trading decisions.

2. Range Trading

Range trading is another effective strategy, particularly in a sideways market. This strategy focuses on identifying key support and resistance levels. Traders buy when the price approaches the support level and sell when it reaches the resistance level. Pocket Option provides tools that help traders draw support and resistance lines, making it easier to implement this strategy.

3. News Trading

For traders who prefer fundamentals over technical analysis, news trading can be highly effective. This strategy involves monitoring economic calendars and news releases to anticipate market movements. Major events, such as interest rate announcements or economic data releases, can cause significant price fluctuations. On Pocket Option, leveraging news trading requires staying informed and being ready to act quickly.

4. Scalping

Scalping is a high-frequency trading strategy where traders aim to make small profits from a large number of trades throughout the day. This strategy requires a keen eye for market movements and quick decision-making. Pocket Option’s fast execution speed and user-friendly interface make it an ideal platform for scalpers. When scalping, it’s essential to use strict risk management practices, as the high number of trades can amplify losses.

5. Use of Indicators

Indicators play a vital role in trading strategies by providing insights into market trends and potential reversals. On Pocket Option, you can access various technical indicators, including Moving Averages, MACD, Bollinger Bands, and more. Understanding how to use these indicators effectively can enhance your trading strategy and improve your decision-making process.

Market Analysis Techniques

In addition to having a solid trading strategy, it’s essential to understand market analysis techniques. There are two primary types of analysis: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, news events, and overall market sentiment to make trading decisions. Successful traders stay updated on global news, economic reports, and geopolitical events that can impact market conditions.

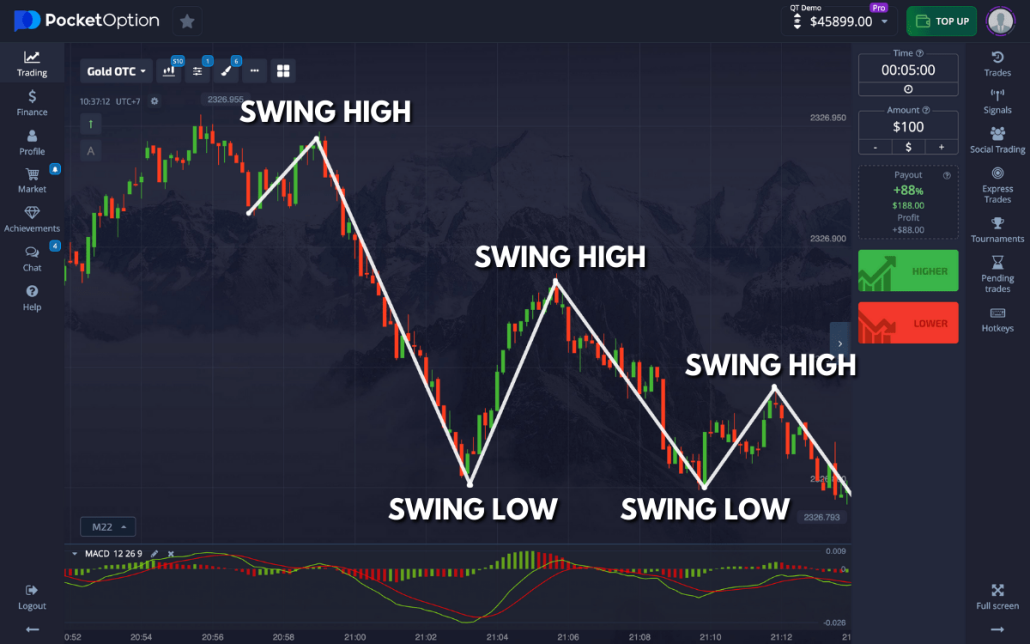

Technical Analysis

Technical analysis focuses on analyzing price charts and historical data to predict future price movements. Traders use various chart patterns and technical indicators to identify entry and exit points. Learning how to read charts effectively is crucial for achieving success on platforms like Pocket Option.

Risk Management in Trading

Effective risk management is equally important as trading strategies and analysis. It helps protect your capital and reduce potential losses. Here are some fundamental risk management techniques to keep in mind:

- Set Stop-Loss Orders: Always set stop-loss orders to minimize losses in case the market moves against your position.

- Diversify Your Portfolio: Avoid putting all your capital into a single trade. Diversification spreads risk across different assets.

- Use Proper Position Sizing: Determine the amount of capital you are willing to risk on each trade to manage your overall risk effectively.

Utilizing the Demo Account

Pocket Option offers a demo account feature that allows traders to practice their strategies and familiarize themselves with the platform without risking real money. This is especially beneficial for novice traders looking to build confidence and polish their skills before moving on to live trading.

Conclusion

Trading on Pocket Option can be an exciting and potentially profitable endeavor if approached with the right strategies and mindset. By understanding various trading strategies, employing effective market analysis techniques, and practicing sound risk management, you can enhance your trading experience and increase your chances of success. Remember, successful trading requires patience, discipline, and continuous learning. As you navigate the trading landscape, utilize the resources available on Pocket Option to hone your skills and stay ahead in the ever-evolving financial markets.